Get the free employee information form

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How to fill out an employee information form: A comprehensive guide

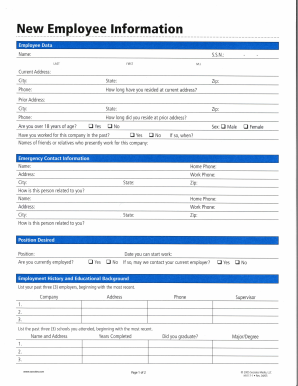

Understanding the Employee Information Form

An employee information form is a critical document used to collect essential data about employees. Its purpose goes beyond mere record-keeping; it ensures that companies have accurate and consistent data for HR processes. The significance of precise data on this form is vital for compliance with various legal obligations, which necessitates that organizations adhere to local, state, and federal regulations concerning employee information.

-

The employee information form is a standardized document that helps gather essential details about current and potential employees.

-

The primary purpose of this form is to facilitate effective employee management, payroll processing, and compliance with legal standards.

-

Accurate completion of the form is crucial to meet legal obligations such as FLSA, FMLA, and equal employment opportunities.

What are the essential components of the employee information form?

The employee information form is composed of distinct sections that need to be accurately completed by both employers and employees. This dual completion ensures that all necessary details are captured effectively.

-

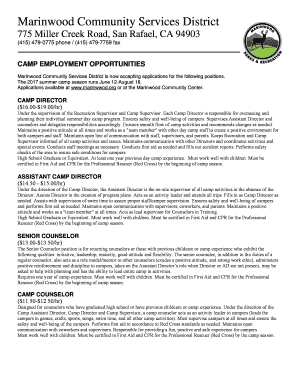

This includes critical details like the client number, employment status, job title, salary, and payroll frequency, which facilitate HR operations.

-

Employees must provide personal information such as their name, address, and contact details, as well as information for emergency contacts.

-

This section must detail at least one emergency contact, including how to reach them, ensuring that the employer can connect promptly during emergencies.

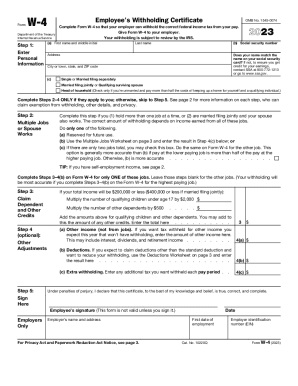

How do you fill out the form fields?

Filling out the employee information form can feel overwhelming, but following a structured guide can simplify the process. Each field is designed to elicit specific information crucial for both current functions and future HR needs.

-

This section includes entering the client number and date alongside selecting the employment status and payroll frequency.

-

Employers must assess and document exemptions based on local guidelines to ensure compliance.

-

The form must include an employee signature, confirming the authenticity of the data provided.

What are best practices for collecting employee information?

Implementing best practices in collecting employee information not only ensures data accuracy but also eases the process for both the employer and employees. Employing the following strategies can significantly enhance your data collection efforts.

-

Encourage employees to review their information thoroughly before final submission to minimize errors.

-

Stay updated on local regulations related to employee data to guide your collection processes.

-

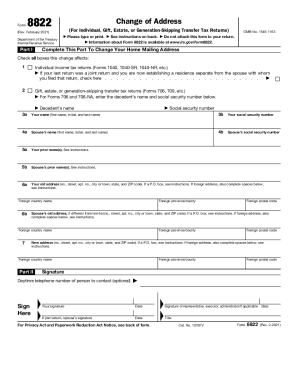

Regularly review and update employee records to ensure compliance and relevancy of the data.

How can you customize and automate the employee information form?

Customization and automation of the employee information form can streamline the process, saving time and reducing workload. Services like pdfFiller provide various tools to tailor the form based on specific needs.

-

You can modify existing templates to include specific fields or instructions relevant to your organization.

-

Use pdfFiller’s suite of interactive document tools for seamless document creation.

-

Leverage automation for data collection and management, reducing manual entry and potential errors.

How does integrating the employee information form into HR processes work?

Integrating the employee information form into broader HR processes is integral for managing employee data. This integration facilitates coherent data usage across various HR functionalities.

-

Connecting the form to existing HR software ensures consistent data flow, enhancing operational efficiency.

-

Make use of trusted third-party suppliers for data security, safeguarding sensitive employee information.

-

Ensure the integration process complies with regulations such as HIPAA and GDPR to protect employee privacy.

What role does technology play in employee information management?

Technology plays a pivotal role in modern employee information management, especially with cloud-based solutions like pdfFiller that enhance collaboration and efficiency.

-

Cloud platforms enable easy access and retrieval of documents from anywhere, facilitating remote work.

-

Utilize collaborative features provided by pdfFiller to improve communication among team members.

-

Emerging technologies, such as AI, are poised to revolutionize how employee information is gathered and managed.

Frequently Asked Questions about new hire employee information form pdf

What is the employee information form?

The employee information form is a document that collects essential details about employees, including personal and employment information. It plays a significant role in HR processes and compliance with legal requirements.

How do I ensure the accuracy of the information provided?

To ensure accuracy, employees should double-check their entries before submitting the form. Employers can also implement a system of verification to confirm the accuracy of submitted data.

What should I do if I make a mistake on the form?

If a mistake is made, it is best to contact the HR department or the person in charge to correct it as soon as possible. Amendments should be recorded officially to maintain accuracy in employee records.

Can I customize the employee information form?

Yes, the employee information form can be customized to better suit the needs of your organization. Tools like pdfFiller provide options for tailoring forms with specific fields and instructions.

What regulations do I need to consider when collecting employee information?

It's essential to consider regulations that govern employee data, such as FLSA, FMLA, HIPAA, and GDPR, depending on your region. Compliance with these laws ensures the protection of employee privacy.

pdfFiller scores top ratings on review platforms